Financial Fog: Why Most Divorces Fail in Discovery

Key takeaway: Financial fog is the number one reason divorce cases stall and collapse. Splitifi Finance Forensics removes the fog by capturing every asset, debt, and account in a structured, judge ready format.

This article explains what discovery is meant to achieve, why it fails so often, and how tools like Splitifi transform the process from chaos to clarity.

The Purpose of Discovery in Divorce

Discovery is the process where both sides exchange financial and factual information. In family law, discovery ensures that each party discloses income, assets, debts, and expenses. Without it, courts cannot divide property fairly or set support accurately.Transparency

Discovery is designed to eliminate surprises. Each spouse must provide sworn disclosure of all relevant information.Fairness

Without full financial discovery, equitable distribution and child support calculations cannot be trusted.Accountability

Discovery compels parties to verify assets and debts under oath, making concealment punishable by law.Efficiency

Well managed discovery accelerates settlement and reduces trial length by clarifying the financial landscape.Each state has its own discovery rules. For example, Rule 26 of the Federal Rules of Civil Procedure governs disclosures in civil cases, while states like California and Florida impose specific family law disclosure deadlines [Florida Courts].

The Reality: Why Discovery Fails

In practice, discovery is rarely smooth. Most litigants struggle to find, organize, or understand the documents required. Attorneys drown in paperwork. Judges receive incomplete or conflicting affidavits. The result is financial fog that blocks clarity.Incomplete Disclosures

Spouses often omit retirement accounts, business interests, or crypto holdings, whether intentionally or accidentally.Document Chaos

Bags of receipts, unorganized bank statements, and inconsistent spreadsheets overwhelm attorneys and clerks.Attorney Overload

Even skilled lawyers miss key documents when discovery arrives late or in unusable formats.Judicial Frustration

Judges must rule with incomplete data, which undermines fairness and prolongs litigation.Key takeaway: Discovery fails because it is fragmented, unstructured, and adversarial. Splitifi Divorce OS converts raw disclosures into structured clarity that judges can rely on.

The Cost of Financial Fog

The failure of discovery is not just a paperwork issue. It has real costs for litigants, attorneys, and judges. These costs are financial, emotional, and procedural.Sanctions

Attorney Fees

Custody Impact

Trial Delays

| Type of Fog | Consequence | Impact |

|---|---|---|

| Hidden Assets | Sanctions or contempt rulings | Loss of trust, potential criminal referral |

| Incomplete Affidavit | Evidence excluded | Skewed property or support orders |

| Late Disclosure | Attorney’s fees awarded | Financial strain on the noncompliant spouse |

| Unorganized Data | Trial delays | Increased costs and judicial frustration |

Data drawn from American Bar Association reports and state family law procedures [ABA].

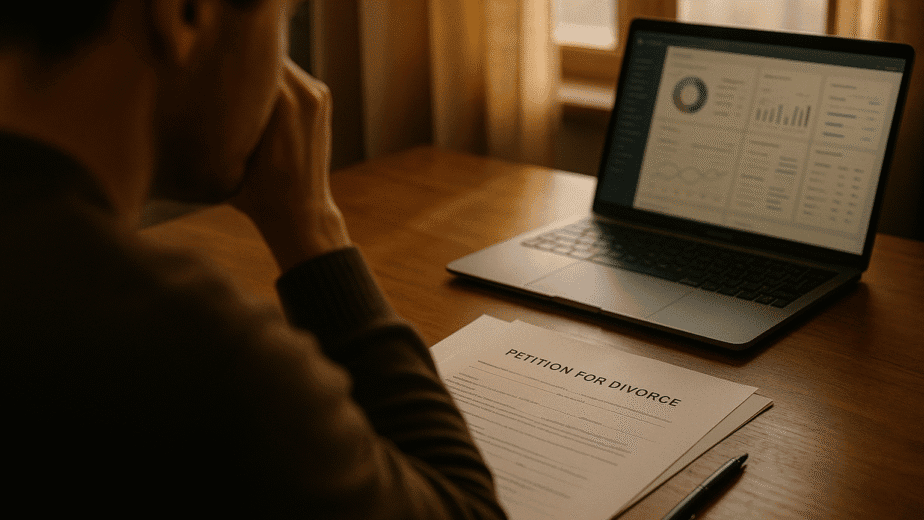

Case Scenario: From Fog to Clarity

Consider a spouse who forgets to disclose a retirement account worth $150,000. The omission is discovered during trial, leading to sanctions, loss of credibility, and an attorney’s fees award against them. The judge questions every other disclosure, and the spouse loses leverage in negotiations. Now consider the same case using Splitifi. During the structured Assets Page interview, the retirement account is captured along with all other accounts, debts, and insurance. The system generates a comprehensive report aligned with state disclosure rules. Instead of losing credibility, the spouse gains trust with both the judge and opposing counsel.Discovery mistakes can permanently damage credibility. Judges assume that if one asset is hidden, others may be too. Splitifi eliminates that risk by ensuring nothing is missed.

Macro Analysis: Discovery as a Systemic Weakness

Discovery is the most failure prone stage of divorce. It generates more motions, more sanctions, and more delays than any other part of the process. The system relies on manual disclosures and attorney review, which is slow and error prone. According to Census data, the average American household holds multiple bank accounts, retirement funds, and debts across institutions [U.S. Census]. Without structured tools, these are easily overlooked. Courts are beginning to explore digital disclosure standards, but most still operate on outdated forms and affidavits.The problem is not that litigants lie more often today. It is that financial complexity has outpaced the manual discovery process. Digital tools are the only scalable solution.

How Splitifi Clears Financial Fog

Splitifi replaces fog with structure. Instead of relying on memory, manual forms, or overloaded attorneys, litigants and judges gain clear, verifiable financial data.Assets Page

Captures every home, vehicle, bank account, retirement account, crypto wallet, and debt with required details.Finance Forensics

Analyzes disclosures for missing data, hidden accounts, or irregularities. Provides judge ready reports.Divorce OS

Integrates financial data with case strategy so litigants never lose track of deadlines or disclosures.Resource Library

Provides guidance, templates, and explanations of discovery rules across jurisdictions.Key takeaway: Financial fog disappears when litigants use structured systems. Explore the Splitifi Trust Center to learn how your data is kept secure during discovery.