7 Money Games Abusers Play After Separation Part 2

Continued from Part 1…

Game Five: The Credit Score Demolition

This is slower and meaner. Your ex stops paying the mortgage on the house they’re still living in. Your name is on that mortgage. Your credit score drops 100 points. Or they stop paying the car loan on the vehicle they drove away in. Again, your name, your credit hit.

Sometimes it’s active sabotage: they pull your credit repeatedly for fake loan applications, triggering hard inquiries. They report you as an authorized user on their accounts and then default. They even dispute legitimate accounts you have in good standing, causing temporary removal from your credit file and confusion for future lenders.

Why This Is Particularly Vicious

Credit damage has cascading effects. It’s not just an abstract number.

You can’t rent an apartment with a 540 credit score. Landlords run credit checks. When they see recent defaults, late payments, and accounts in collections, they reject your application. Now you’re stuck living with family or friends because you can’t get approved anywhere.

You can’t get approved for a car loan, or if you do, the interest rate is predatory. That $15,000 used car now costs you $22,000 over five years because your rate is 18% instead of 6%.

Some employers run credit checks, especially for positions involving financial responsibility. A trashed credit report can cost you a job opportunity.

Insurance rates go up. Some utility companies require deposits if your credit is poor. Even getting a cell phone plan becomes complicated.

This is financial abuse after separation at its most strategic. Your ex isn’t just withholding money from you. They’re systematically destroying your ability to access credit, housing, and employment in the future.

Your Counter-Strategy

Pull your credit report from all three bureaus immediately: Equifax, Experian, and TransUnion. You can get free reports at AnnualCreditReport.com. Review every single line.

Set up fraud alerts with all three bureaus. This requires lenders to verify your identity before opening new accounts. It’s a soft protection that adds friction for anyone trying to open credit in your name.

Better yet, freeze your credit entirely. A credit freeze prevents anyone, including you, from opening new accounts until you temporarily lift the freeze. It’s free and takes about 15 minutes to set up with each bureau. This stops your ex from applying for credit cards or loans in your name.

If unauthorized activity appears, file a police report and send it to the credit bureaus with a dispute letter. If your ex applied for credit using your information without permission, that’s identity theft. The police report creates an official record and strengthens your dispute with creditors.

If your ex stops paying joint debts like the mortgage or car loan, you have a choice: let it default and tank your credit, or make minimum payments yourself and seek reimbursement in the divorce settlement.

The strategic move is often to make payments yourself, document every payment meticulously, and request reimbursement plus interest in the final divorce decree. Yes, it costs you money upfront. But it protects your credit and creates a clear record of your ex’s non-compliance that courts can sanction.

For future protection, once joint debts are resolved in divorce, refinance or sell shared property as fast as possible. Get your name off mortgages, car loans, and any other shared obligations. Until those accounts are in one name only, you’re vulnerable to the other person’s financial decisions.

Game Six: The Job Sabotage

Your ex calls your workplace and tells HR you’ve been stealing. They show up at your office and cause a scene. They blow up your phone during meetings until you’re written up for distraction. They sabotage your childcare arrangements so you miss shifts repeatedly and get fired for unreliability.

Why? Because if you can’t work, you can’t afford to leave. You’re more likely to settle for less. You’re more likely to give in on custody to avoid conflict. You’re more dependent.

The Pattern

Employment interference often starts subtle. Text messages during work hours that you “need” to respond to immediately. Phone calls that escalate when you don’t pick up. Showing up at your workplace “just to talk.”

Then it escalates. False reports to your employer. Allegations of misconduct or theft. Public confrontations that embarrass you in front of colleagues. Deliberately causing you to miss important meetings or deadlines.

The most insidious version involves childcare sabotage. Your ex agrees to watch the kids during your shift, then calls 20 minutes before you’re supposed to leave and says they can’t make it. Or they pick up the kids from daycare without telling you, forcing you to leave work in a panic. Or they manufacture “emergencies” that require you to leave work immediately and repeatedly.

After enough incidents, your employer loses patience. You’re unreliable. You’re distracted. You’re involved in “drama.” And suddenly you’re on a performance improvement plan or worse, terminated.

Your Counter-Strategy

Get a protective order that includes workplace stay-away provisions. Most states allow you to request that the respondent stay away from your place of employment as part of a restraining order or protection order.

Notify your employer and HR in writing that you’re dealing with domestic abuse and provide a copy of the protective order. Ask them to document any incidents where your ex contacts them or shows up at the workplace. Many employers have policies to support victims of domestic violence, but they can’t help if they don’t know what’s happening.

Block your ex’s number during work hours. Use a communication app like OurFamilyWizard or Talking Parents for all co-parenting communication. These apps create time-stamped records and discourage harassment because everything is documented.

Set up backup childcare with a friend, family member, or paid service so one missed pickup doesn’t cost you your job. Build redundancy into your childcare plan. If your ex is responsible for pickup on Tuesdays and Thursdays, have a backup person who can cover if they flake.

Document every harassing call, every text, every incident. Screenshot. Save voicemails. Write down dates, times, and what was said. If your employer is documenting incidents from their end, request copies of those incident reports for your records.

This creates a pattern-of-conduct record that’s powerful in court. One incident looks like a misunderstanding. Ten incidents over three months is a campaign of harassment designed to destabilize your employment.

Game Seven: The Controlled Access Lockout

You need the tax returns to file financial disclosure. Your ex has them and won’t turn them over. You need the title to the car to sell it. Your ex claims they don’t know where it is. You need access to the house to retrieve your documents. Your ex changed the locks.

This is about friction. The more barriers they create, the more time and energy you burn just trying to access basic information you’re legally entitled to. It delays your case. It costs you attorney fees. It makes you look disorganized to the court when you can’t produce simple documents.

Common Lockout Tactics

Withholding tax returns, pay stubs, bank statements, or other financial documents necessary for discovery. “I’ll get them to you” becomes a stalling tactic that lasts weeks.

Refusing access to the marital home where your personal documents, photos, and belongings are stored. They changed the locks. They claim you “abandoned” the property and forfeited your right to access it.

Keeping titles to vehicles, deeds to property, or other legal documents that you need to exercise your rights or complete transactions. Without the title, you can’t sell the car. Without the deed, you can’t prove ownership.

Withholding children’s school records, medical records, or passport. You need your child’s birth certificate for school enrollment or their medical records for a new doctor, but your ex “can’t find them” or simply ignores your requests.

Changing passwords on shared accounts like utilities, insurance, or online banking. Now you can’t access information about accounts you’re still legally responsible for.

Your Counter-Strategy

Stop asking your ex for cooperation. They’ve already shown they won’t give it. Go around them using legal tools designed exactly for this situation.

File motions to compel discovery and request sanctions for non-compliance. Courts have explicit rules about financial discovery. If your ex doesn’t provide required documents within the specified timeframe, you can file a motion asking the judge to order compliance and sanction them for the delay.

Subpoena third parties directly. Get tax returns from the IRS by filing Form 4506-T. Get title duplicates from the DMV. Get bank statements directly from the bank. Get employment records from your ex’s employer. Get medical records from your children’s doctors. Get school records from the school district.

Most of these entities will provide copies if you present proper identification and follow their process. Yes, there might be small fees. But $25 to get a copy of a document is better than waiting three months for your ex to “find” it.

Request a court order for a police escort to retrieve personal property from shared residences. In most jurisdictions, you can ask the court for a civil standby order, which directs law enforcement to accompany you to the property so you can retrieve your belongings safely and without interference.

For password-protected accounts, contact the company directly. Explain you’re in divorce proceedings and need access to accounts in your name. Some will reset passwords or provide statements if you verify your identity. For jointly-held accounts, you may need a court order requiring the other party to provide access credentials.

The key principle: every document, every piece of information, every asset has a legal pathway to access it that doesn’t require your ex’s voluntary cooperation. Use those pathways.

7 Steps to Stop Financial Abuse After Separation

- Separate your finances within 72 hours. Open a new bank account in your name only at a different institution. Reroute your direct deposits. Transfer your share of any joint accounts if possible. Close or freeze joint credit cards. This isn’t about being fair; it’s about preventing ongoing harm. The first three days after separation are critical. Act fast.

- Pull your full credit report and freeze your credit. Get reports from all three bureaus: Equifax, Experian, and TransUnion. Look for accounts you don’t recognize, inquiries you didn’t authorize, and address changes you didn’t make. Place a credit freeze so no new accounts can be opened without your explicit approval. Link to Splitifi Financial Discovery tools.

- Document every financial interaction meticulously. Create a spreadsheet tracking support payments, missed payments, unauthorized charges, and asset transfers. Screenshot text messages about money. Save emails. Print bank statements. The more systematic your documentation, the more credible your claim of financial abuse after separation becomes to the court. Date everything. Note amounts. Attach copies of communications.

- File for temporary orders immediately. Don’t wait for the final divorce hearing. File for emergency temporary support, exclusive use of property, and restraining orders preventing asset dissipation. Courts can act quickly on these motions if you show immediate harm. Waiting six months costs you leverage and credibility. Temporary orders can be in place within weeks and protect you during the entire divorce process.

- Use forensic tools for hidden assets. If you suspect your ex is hiding money, hire a forensic accountant or use Splitifi Command Dashboard asset tracking features. Subpoena financial records, tax returns, and business documents. Hidden assets only stay hidden if you don’t look hard enough. Lifestyle analysis, third-party subpoenas, and pattern recognition can uncover assets your ex thought were safely concealed.

- Request automatic enforcement mechanisms. Instead of relying on your ex to voluntarily pay support, ask the court for an income execution order that garnishes wages directly from their employer. For hidden assets, request liens on property or frozen accounts until asset division is complete. Automation removes the abuser’s discretion. They can’t “forget” or decide to short you when the money never touches their hands.

- Pursue contempt and sanctions aggressively. If your ex violates financial orders, file for contempt immediately. Request not just compliance but also reimbursement for your attorney fees, interest on unpaid amounts, and sanctions that hit them where it hurts. Courts have tools to punish financial misconduct, but only if you invoke them. Don’t wait until you have ten violations. File after two. Make it clear you will enforce every order, every time.

What Courts Actually Do About Financial Abuse

Here’s the frustrating truth: courts can do a lot, but they don’t do it automatically. You have to ask. Specifically. With evidence.

If you file a motion that says “my ex is being difficult about money,” you’ll get a lecture about cooperation and maybe a request to try mediation. If you file a motion that says “my ex has missed four consecutive support payments totaling $3,200, violated the automatic restraining order by withdrawing $12,000 from our joint savings, and opened two new credit cards in both names after separation,” and you attach documentation of all of that… you’ll get a court order with teeth.

Judges have wide discretion to sanction financial misconduct. They can award you attorney fees for having to enforce basic obligations. They can impute income to an ex who’s suddenly “unemployed.” They can award you more than half of assets if they find the other party hid or wasted marital property. They can hold someone in contempt, which can include fines or even jail time for repeated violations.

But all of that requires you to ask and prove. The court isn’t going to investigate on its own.

This is why financial abuse after separation often continues unchecked. Not because courts don’t care, but because victims don’t know how to frame it in terms the legal system responds to. They complain about being broke instead of providing a forensic timeline of asset dissipation. They express frustration about non-payment instead of filing for contempt with a payment ledger attached.

The law is on your side. You just have to speak its language.

Real Case: Sarah’s Story

Sarah separated from her husband of 14 years after escalating verbal and financial control. She moved into a rental with their two kids. He kept the house and agreed verbally to pay $2,400 monthly in temporary child support until the divorce was finalized.

The first payment came on time. The second was a week late. The third was $1,600 instead of $2,400 with a text saying “tight this month.” The fourth never came at all.

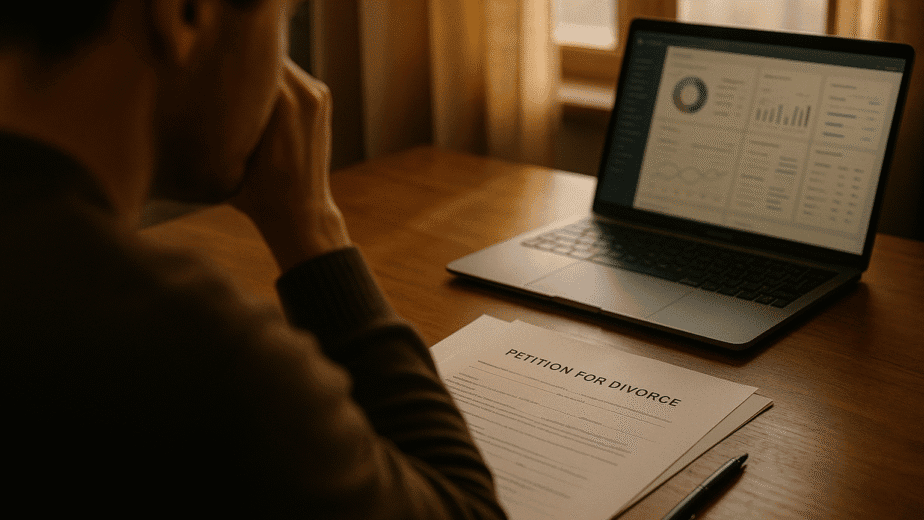

Meanwhile, Sarah started getting calls from credit card companies about overdue balances on joint accounts. Her ex had maxed out three cards totaling $18,000 in charges on purchases she knew nothing about: electronics, sporting equipment, hotel stays. Her credit score dropped from 720 to 610 in six weeks.

She called a lawyer. The lawyer told her to document everything and file for contempt. Sarah created a spreadsheet showing every missed and short payment. She printed credit card statements highlighting charges after the separation date. She pulled her credit report showing the damage. She saved every text message where he promised payment “next week.”

At the emergency hearing three weeks later, the judge was not amused. He ordered immediate income execution: future child support would be garnished directly from the ex-husband’s paycheck through the state disbursement unit. He ordered reimbursement of all unpaid support ($5,200) plus 10% annual interest. He assigned 100% of the post-separation credit card debt to the ex-husband and made it non-dischargeable. He ordered the ex-husband to pay Sarah’s attorney fees for the contempt motion, which were $1,800.

Total time from filing to order: three weeks. Total cost in attorney fees to Sarah after reimbursement: zero. Amount recovered in unpaid support and avoided debt: $23,200.

Why Money Becomes the Weapon

Financial abuse after separation isn’t about greed. It’s about control.

When an abuser loses physical proximity (you’re not in the same house anymore) and social control (you’re not isolated from friends and family anymore), they shift to the one lever they still have access to: money.

This is especially true in relationships where one partner controlled the finances during the marriage. They know where every account is. They know the passwords. They know what you don’t know. And they use that information asymmetry as a weapon.

Research from the American Psychological Association shows that economic abuse is one of the strongest predictors of whether a victim will return to an abusive relationship. It’s not love or fear that brings people back. It’s often the inability to afford to stay gone.

Abusers understand this intuitively. They know that if they can make your life financially unworkable, you have three choices: come back, accept terrible terms in the divorce settlement, or fight a prolonged legal battle you can’t afford. All three outcomes favor them.

That’s why responding to financial abuse after separation requires more than just “getting a good lawyer.” It requires systematically removing the abuser’s ability to create financial chaos. That means automating payments they can’t withhold. Freezing assets they can’t hide. Enforcing orders they can’t ignore. And documenting everything so courts see the pattern, not isolated incidents.

You can’t negotiate with someone whose goal is your destabilization. You can only systematically eliminate their leverage until cooperation is their only remaining option.

How Splitifi Helps You Fight Back

Financial abuse after separation thrives in chaos and poor documentation. Splitifi’s tools are designed to eliminate both.

The Divorce Command Dashboard gives you a central place to log every financial interaction: missed payments, unauthorized charges, asset transfers, and communications about money. You’re building a contemporaneous record that’s admissible in court and far more credible than trying to reconstruct events from memory six months later.

The Financial Discovery toolkit helps you identify hidden assets by generating targeted subpoena requests, tracking account discrepancies, and flagging suspicious financial activity patterns. You don’t need a $15,000 forensic accountant for basic asset tracking. You need organized data and the right questions.

The Evidence Log system automatically timestamps and organizes your documentation so when your attorney files for contempt or sanctions, they have a clean, organized record to attach to the motion. Courts respond to organized evidence. They ignore complaints without proof.

And the asset tracking features integrate with your financial accounts to automatically flag unusual transfers, new accounts, or suspicious activity. You get alerts when something doesn’t match the pattern. You’re not trying to manually review hundreds of transactions. The system does the heavy lifting and surfaces what matters.

This is what levels the playing field. Your ex might have controlled the money during the marriage. But you have tools specifically designed to expose that control, document the abuse, and give courts exactly what they need to sanction the behavior.

Data over drama. Structure over chaos. That’s how you win.

FAQ

- What is financial abuse after separation?

- Financial abuse after separation is a pattern of economic control tactics used by one party to destabilize, manipulate, or force compliance from the other party. Common tactics include withholding court-ordered support, draining joint accounts, running up joint debt, hiding assets, sabotaging credit, and interfering with employment.

- Can I close joint bank accounts without my spouse’s permission?

- You can typically withdraw up to half of joint account funds without permission in most states, and you should open a new individual account immediately. However, completely closing a joint account usually requires both parties’ consent or a court order. The better approach is to remove your funds, stop using the joint account, and document everything.

- What should I do if my ex maxes out joint credit cards?

- Contact each creditor immediately to notify them you’re separated and dispute charges made after the separation date. Request the account be frozen. Close joint accounts if possible. Pull your credit report to identify all joint accounts. Document unauthorized charges with statements. In your divorce case, request that post-separation debt be assigned to the person who incurred it.

- How do courts handle hidden assets in divorce?

- Courts take hidden assets seriously and can impose sanctions including awarding the injured party more than half of the hidden asset value. You can use subpoenas, forensic accountants, and formal financial discovery to uncover hidden accounts, business interests, cryptocurrency, and other concealed property. Both parties must provide complete financial disclosure under penalty of perjury.

- Can my ex really be jailed for not paying support?

- Yes. If someone willfully violates a court order to pay support, they can be held in civil contempt. Judges can impose fines, order payment of your attorney fees, and in cases of repeated or egregious violations, order jail time until the person complies with the support order. However, this requires you to file for contempt and prove the violation.

- How long does it take to get temporary support orders?

- In most states, emergency temporary orders can be obtained within two to four weeks if you demonstrate immediate financial hardship. Some jurisdictions have expedited procedures for support orders that can result in orders within days. The key is filing immediately after separation and showing the court that you need relief now, not six months from now when the final hearing occurs.

- What if I can’t afford a forensic accountant?

- If your case involves significant hidden assets but you can’t afford a forensic accountant upfront, consider asking the court to order your spouse to pay for one as part of temporary attorney fees and costs. Alternatively, you can use systematic documentation tools like Splitifi’s Financial Discovery toolkit to do basic asset tracking yourself, then hire an accountant only for the specific complex issues. Some forensic accountants work on contingency or reduced rates if they believe significant assets will be recovered.

The Bottom Line

Financial abuse after separation is predictable, systematic, and entirely stoppable if you know what you’re dealing with.

Your ex is betting you won’t enforce orders. That you won’t document properly. That you’ll be too overwhelmed or too conflict-averse to use the legal tools available to you. That you’ll eventually fold because fighting costs too much money and energy.

They’re wrong.

You document everything. You file for enforcement after the second violation, not the tenth. You use income execution orders to automate support. You pull credit reports and freeze accounts. You subpoena financial records instead of begging for cooperation. You request sanctions that make non-compliance more expensive than compliance.

And you use tools specifically designed for this fight. Because manual spreadsheets and memory don’t cut it when you’re dealing with someone who’s spent years controlling the money and knows every trick in the book.

The law is on your side. The tools exist. What matters now is whether you use them.